|

Interview with Jude ThompsonChairman of the Board for Delta Dental Insurance of Kentucky Forward by Ryan Eaton at Morgan White Group |

For this quarter’s newsletter, we have chosen someone dynamic for our featured article. He has agreed to share power-packed leadership, business management, and life development advice with each of us.

I had the privilege of meeting Jude Thompson several weeks ago, and after spending 15 minutes with him, I knew we had to ask him to share some of his life experiences with our team. His charisma, his leadership and market knowledge all made me realize he could offer valuable words of wisdom for those of you who read the MWG Broker Services Newsletter each month.

Before we get to the meat of this article let me tell you a little bit about Jude.

- He is current Chairman of the Board for Delta Dental Insurance of Kentucky

- He previously served as Co-CEO and President of Papa John’s Pizza

- He was President of Anthem Blue Cross and Blue Shield of Kentucky

- He is also a partner in AgentLink

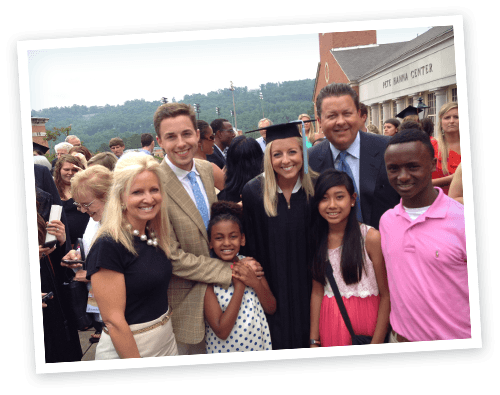

- Jude’s wife and 5 children (3 of which he adopted — 1 daughter from Cambodia and one son and one daughter from Ethiopia) are most important in his life.

It was an honor to interview Jude. The hour and a half he spent talking to me is more than appreciated and will resonate with me for a very long time. I don’t believe anyone who reads this article can walk away without being both touched and enlightened.

Ryan

You have held many executive level positions in national companies throughout the years. Would you mind sharing the best business lesson you have learned?

One of the greatest lessons I have learned is the Power of Simplicity. Too often, people try to impress others with their knowledge; however, if it’s not easy to understand, people stop listening. From a team-leading standpoint, you have to speak in terms your team can comprehend, otherwise you won’t have the interest or momentum needed to reach your goals.

Another big lesson is, “Measure Three Times, Cut Once” when it comes to hiring. Hire the right people and spend extra time on the front end so you don’t have to circle back and retrain down the road. No one enjoys that.

Consistency is crucial in business. I’m not saying you should live in a box and never venture out. Think about it as if you were shooting free throws. You need to try to have the same motion each time you shoot. If, after practicing your shots from the ground, you try to jump while shooting, it’s going to be ugly.

Between managing people, reviewing P&L’s, keeping up with the insurance market and 7,000 other things on your plate, what do you think is the most important thing to keep in the forefront with regards to running a successful business?

First things first, you have to learn “NO” is not a bad word. No one likes to say no. In fact I wish I could say yes to everyone. However, if you say yes to everyone, you won’t be good at anything. Before you answer, you should learn to ask yourself if it supports what you are trying to accomplish.

A lot of leaders tend to think they have to know it all. As a leader, you don’t need to know everything. However, you do need to understand who knows how to get the task accomplished. Everyone has different skill sets which you must learn to utilize. For instance, if you have a team of college baseball players who all line up on the mound to pitch, but play no other positions, a team of kindergarteners could beat them. Utilize different skill sets. Remember: “The seeds of destruction are sown at the victory party”. The day you say you know it all is the day you will start to fail.

What skill set has energized your success in the insurance industry? How do you sharpen this skill?

Everyone has products, people, skills, and resources which help them achieve success. However, individuals should work for their goals by using their line of work as a tool to help them realize their dreams. Don’t believe you wear a cape and can leap a building in a single bound. Evaluate your skills, hang on to them, and do things which will sharpen them.

Given the change in our industry over the past few years, what do you think separates agents who finish strong versus the agents who allow market uncertainty to dominate their business?

Change brings opportunity. Change can make you nervous or scared, but the key is to stay calm through the storm. Although your boat will get rocky at times while feeling the impact of the waves, you must keep a steady head in business to prevent things from getting worse.

Successful organizations learn to pivot. If your business has been hurt by individual commissions shrinking, start thinking about what you can do to service those clients in another fashion? If your groups are up in arms over ACA changes, be there to help them – they just want to know you’re going to handle it. You didn’t create the ACA, but you can help your clients remain calm during the storm.

If you have ever been to a dog kennel, more than likely have heard all of the dogs barking in the back. Usually you will find out it is caused by one dog. If you get rid of the barker, the rest will calm down. Oftentimes people don’t know why they are barking, they simply do it because everyone else is barking.

Communication is key in any industry. The way people communicate with one another has changed at an incredible pace. Some millennials don’t know how to sit down at the dinner table without picking up their cell phone and some baby boomers don’t even know how to use a cell phone. What do you think is key for insurance agents to understand about communication moving forward?

People like to be spoken to in the manner in which they speak. If people communicate by phone, that is how they want to communicate, and that’s how we need to communicate with them.

It’s important to know how your customers or clients communicate. As a marketing and sales person, I want to own, master, or service the distribution highway to the best mousetraps. I never was the guy that could build the best mousetrap, but I like to have multiple paths (sales techniques) to that mousetrap.

My children worked while they were in high school, but I only allowed them to work as a cashier at a grocery or clothing store. I knew they were good at typing on the phone, but the skill set of looking people in the eye and talking with them face-to-face is something I wanted to make sure they could do.

When I was at your office last week, we discussed some new concepts in marketing and reaching clients. Would you share what you’ve learned about thinking outside of the box?

The key to learning more is to wake up thinking you don’t know everything. This understanding will instill a desire to learn even more. Humility is key in business – there is always something else we can discover and absorb. We can learn from the people around us, but if we think that we know it all, we cease to learn.

The devil’s tool is deception. He tries to keep you busy so you think you’re accomplishing something. You are being deceived. Be cautious of “Busy”. Don’t fill up every spot on the calendar. Make sure the things you are doing bring value. Block off time to say “No”. There is nothing wrong with a 15 minute meeting. You see, deception is like a spider web, walk into a single strand and you’re entangled.

According to McKinsey & Co, the average age of a US insurance agent is 60 years. In addition, one-fourth of the industry’s work force is predicted to retire by 2018. What opportunities do you see available in the coming years?

I don’t like averages. Averages will get you in trouble. Averages and statistics tell you the story they want to tell, not necessarily what is accurate. Averages diminish greatness and elevate people who shouldn’t be on the chart. Papa John taught me this many years ago.

You know, 60 is not the same thing 60 used to be (maybe that’s because I’m 54). I look at it like this; when you are 60-years-old, you should be in your prime. You have learned a lot and you’re at the peak of your game, so why stop now. However, if 60-year-olds quit learning to adapt, there will most certainly be a negative outcome. Some may refuse to learn about ACA or refuse to grow with technology. If that’s the case, whether you are 30 or 60, you will eventually be pushed out of the market.

Given your experience in the health market I would like to ask two questions:

a) What are some struggles Major Medical carriers are facing now that your average insurance agent might not see taking place behind the scenes?

First, don’t dehumanize the carriers. They are feeling the same pain we are feeling, but on a much larger scale. Agents across the country have to learn how to be more creative and determine how to bring value to the carriers. Ask yourself: What are their pain points? How can I service them outside of my regular capacity as an agent?

Carriers purposefully cut off commissions because they needed to kill the distribution of products bringing losses to the insurance companies. They weren’t trying to hurt the agents/agencies, they were simply trying to get people to stop selling products which were losing money. The answer is not to roll over and throw in the towel. We have to carefully evaluate what we can market to clients who have individual major medical with us.

b) Given the shuffling of group dental insurance among carriers, it seems as though more dental carriers are interested in the individual market. Do you mind sharing your thoughts on the individual dental marketplace and what we can expect in the coming years?

I agree group business is being shuffled around between carriers. However, all carriers want a profitable business model and to see those profits stay on the books. Because the cost of medical insurance has risen for employers, and they don’t have as much disposable income to cover additional products, I see nothing that would suggest the individual market will slow down.

What risks do you think businesses should or should not take?

I have always thought about my business as a ship. I never want to take a risk that could sink it. You might be able to withstand a little water, but putting it all in the red for the sake of your company and employees is not responsible. Maybe it’s just in my nature, but I think pride can sometimes cause people to either think some things are too good to be true, or they have found the magic bullet.

If you make a mistake which doesn’t sink the ship, it is important to dismantle and observe your failure. There is learning in burning. Remember, no one ever wants to step up to get their nose bloodied, but if you do, you can learn from it.